Transcription

1

00:00:03.370 –> 00:00:11.120

Steve Kessler: Good morning, everyone, and welcome to the Infinit-I Workforce Solutions Fast Forward Webinar Series.

2

00:00:11.350 –> 00:00:14.079

Steve Kessler: sponsored by Vertical Alliance Group.

3

00:00:14.200 –> 00:00:25.400

Steve Kessler: My name’s Steve Kessler, and I’m gonna be the host of the program this morning. We have a really a good topic this morning. Fleet accidents in today’s litigious culture.

4

00:00:25.450 –> 00:00:31.170

Steve Kessler: Think those of us in that have commercial fleets out on the road are fully aware of the

5

00:00:31.220 –> 00:00:54.689

Steve Kessler: the problems. And the non stop lawsuits that we seem to run into. So we have a really good program set up for this morning. Why don’t you all jump on the chat and just tell us who you are and where you’re from, and maybe where you’re calling in from, and what your company while you’re doing that I’m gonna introduce a few folks first of all, my

6

00:00:54.710 –> 00:01:06.630

Steve Kessler: co-host is Mark Rhea. Those of you that have been on our webinars in the past. Mark’s a regular on our program. He’s a veteran transportation executive of about 35 years.

7

00:01:06.800 –> 00:01:10.549

Steve Kessler: So we’re always glad to have you on the program. Good morning, Mark.

8

00:01:10.760 –> 00:01:19.799

Mark Rhea: Morning, Steve. We’ve got. We’ve got a great setup today. We’re gonna talk about loss control risk management and

9

00:01:20.210 –> 00:01:29.480

Mark Rhea: today is much different than it was 5 years ago, 10 years ago. So we’ve got our friends from Shreveport, Louisiana. Really look

10

00:01:29.570 –> 00:01:33.160

Steve Kessler: forwarded the days of a seminar great

11

00:01:33.360 –> 00:01:49.769

Steve Kessler: to introduce our our panelists and our guest today, I’d first like y’all, to welcome Jeffrey Leblanc. Jeffrey is director of Lost Control Department at Kirby’s, and Nelson risk management firm in Shreveport, Louisiana. He’s been there since

12

00:01:49.810 –> 00:01:51.620

Steve Kessler: 2010

13

00:01:51.660 –> 00:02:00.150

Steve Kessler: Jeff received his Bachelor of Science Degree in business administration from Louisiana Tech University in 92.

14

00:02:00.330 –> 00:02:10.770

Steve Kessler: His insurance career, started in 94, working as a claims and accident specialist for 3 major insurance companies over a 15 year time span.

15

00:02:11.150 –> 00:02:19.119

Steve Kessler: Jeffrey has extensive background and property and casualty claims in both commercial and residential applications.

16

00:02:19.370 –> 00:02:33.780

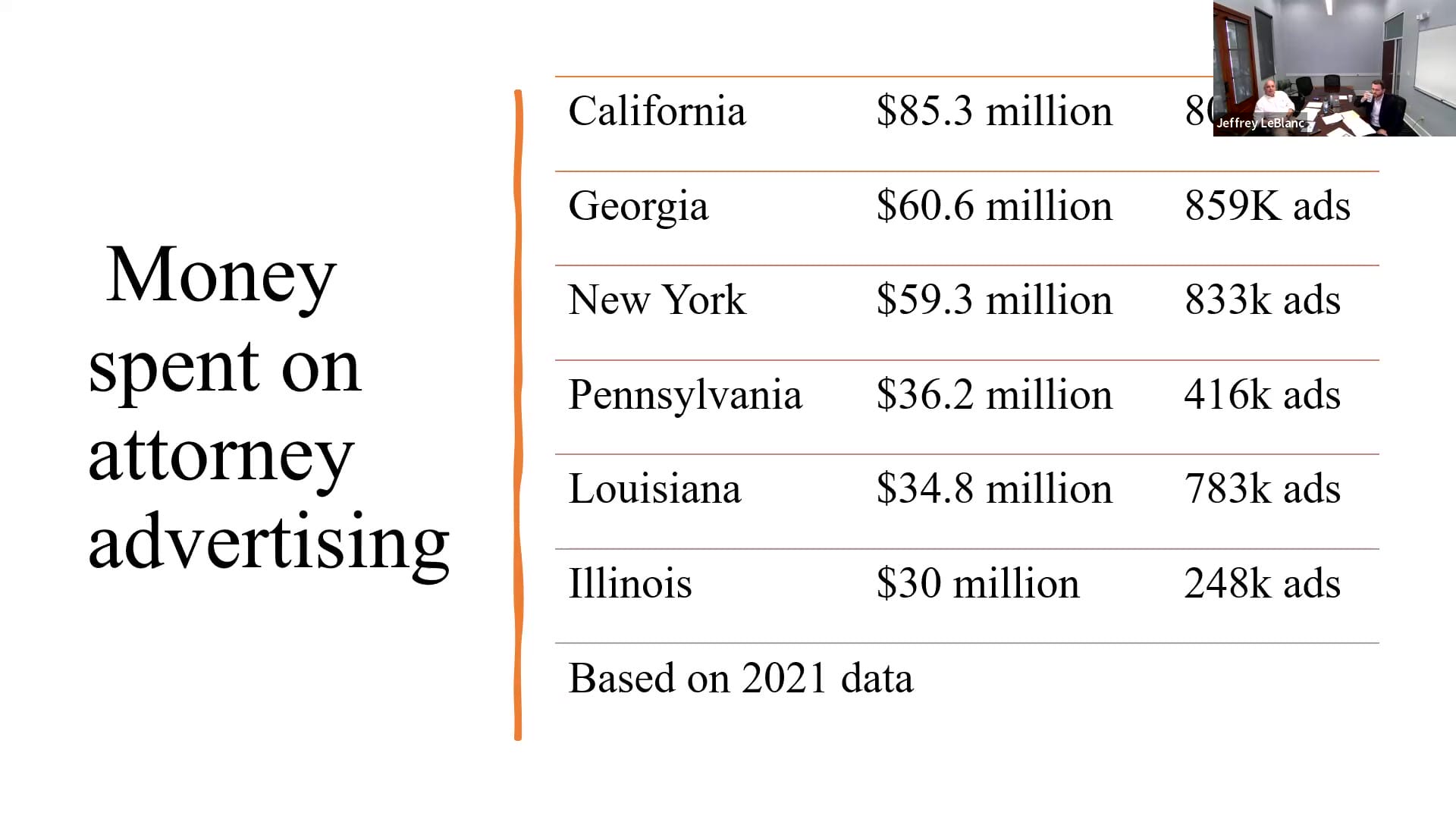

Steve Kessler: Jeff is certified through the Board of Certified Safety Professionals, and has attained his associate safety professional, certified safety professional, and certified instructional trainer designations.

17

00:02:34.010 –> 00:02:40.630

Steve Kessler: Jeff has also received his certified safety and health official designation in construction.

18

00:02:40.670 –> 00:02:48.539

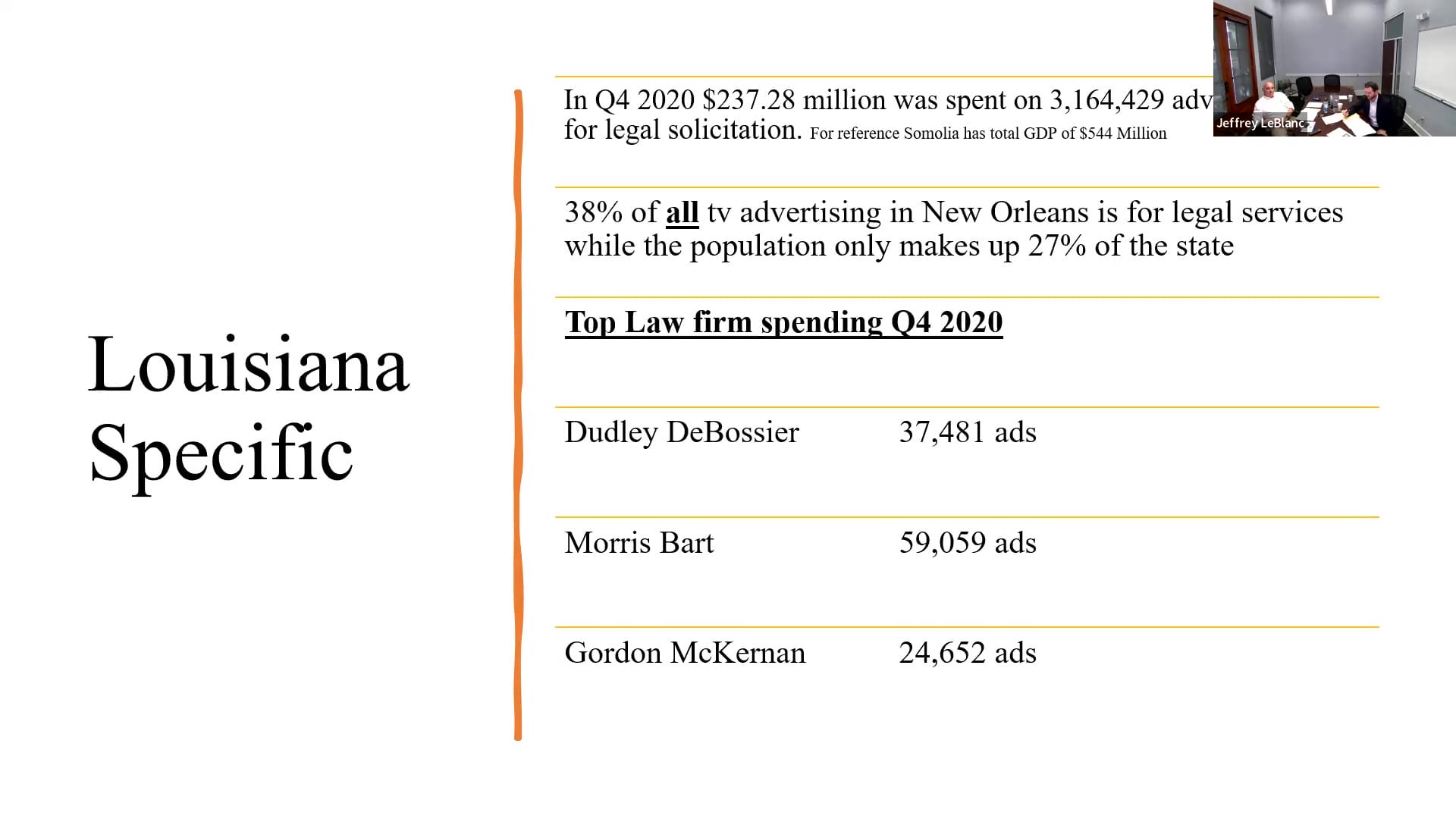

Steve Kessler: and his specialists in safety and health designations in general industry from the University of Texas at Arlington.

19

00:02:49.110 –> 00:02:56.520

Steve Kessler: Also, I’d like for y’all to welcome Jeff’s guests. There is Luke Whetstone.

20

00:02:56.580 –> 00:03:03.880

Steve Kessler: Mr. Whetstone. And, by the way, he’s an associate at Cook, Yancey and King and Galloway in Shreveport.

21

00:03:03.950 –> 00:03:13.799

Steve Kessler: Mr. Whetstone primarily represents and advises corporate and insurance clients, including energy and transportation companies

22

00:03:13.810 –> 00:03:16.170

Steve Kessler: in civil litigation matters.

23

00:03:16.260 –> 00:03:24.129

Steve Kessler: His litigation experience includes jury and bench trials as well as injunction hearings and administrative proceedings.

24

00:03:24.330 –> 00:03:30.290

Steve Kessler: He represents clients in a court on a variety of issues, including casualty and tort liability.

25

00:03:30.380 –> 00:03:41.649

Steve Kessler: labor and employment disputes and contract disputes. So we have an excellent panel of folks joining us this morning. Welcome, Jeff, welcome, Luke.

26

00:03:42.160 –> 00:04:00.389

Jeffrey LeBlanc: Thank you for that introduction, Steve, Mark. We’re Mark, Luke, and are very excited to be here. Talking about something that’s really a hot button item with what my, my firm does, and we see it every day, and it’s been evolving is as Steve said.

27

00:04:00.510 –> 00:04:14.929

Jeffrey LeBlanc: I I’ve got 14 years of or 15 years claims jester experience. I came to work for for Kirby’s, and Nelson started with a lost control department safety been doing that since 2013. So I’ve seen a lot of things change. And the way this.

28

00:04:14.930 –> 00:04:37.590

Jeffrey LeBlanc: the way this program of all was looking out. I’m I’m lucky to have Luke, not only as a counterpart business, but we’re we’re friends as well. We were sitting around 1 point even talking about it. The knowledge that we’ve acquired over the years is, it seems like the auto claims have changed over the years. And so we started. Put some stuff down on paper, and this is what turned out. So we’re ready to jump on in if you hit the next slide, please.

29

00:04:37.700 –> 00:04:45.069

Jeffrey LeBlanc: So, everybody, these are some pictures of I’m in North Louisiana. If if y’all are familiar with what Louisiana looks like. If you think about the Boot

30

00:04:45.120 –> 00:04:56.750

Jeffrey LeBlanc: Street ports up in the top left hand corner we’re about 30 miles east of Texas, and then we’re about an hour south of Arkansas, the architects area.

31

00:04:56.860 –> 00:05:03.530

Jeffrey LeBlanc: But these are the billboard attorneys. Not making fun of these guys or anything. But these are the guys. Everybody’s got

32

00:05:03.910 –> 00:05:24.889

Jeffrey LeBlanc: the billboard attorneys in their area. Mark just drove through Shreveport, heading to Vicksburg, and I said, man, count the billboard signs, and I drove down Gulf Shores probably about a month or so ago, and for Rustin, which is right in the middle of the boot to the state line there were 34 billboard signs just heading east.

33

00:05:24.890 –> 00:05:45.089

Jeffrey LeBlanc: and I told Mark I said I’d be willing to bet that there’s probably another 34 heading back the other way, and we were laughing before and about how many billboards there are. But if you look at these guys up in the top left hand corner Morris Bart if you all are in the goal in the lower half, you know Morris Bart. He’s the guy who kind of changed the game. When he came out of

34

00:05:45.230 –> 00:05:52.709

Jeffrey LeBlanc: out of college, he said. I’m gonna make the plan of the personal injury gain

35

00:05:52.730 –> 00:06:11.279

Jeffrey LeBlanc: very corporate. It is one call that’s all that’s his deal, and and he’s made a ton of money. You’ve got Jacqueline Scott. It’s kind of humorous. Look at our laugh because she she got a a video of her getting on a plane. It’s it’s probably a 20 million dollar jet. And jokingly I said

36

00:06:11.830 –> 00:06:23.529

Jeffrey LeBlanc: that that airplane is probably never set foot in the Shreveport airport. You know it is. It’s just amazing what they’ve got. But anyway, these guys are the the billboard guys, and everybody’s got. If you flip next slide, please.

37

00:06:23.650 –> 00:06:27.819

Jeffrey LeBlanc: So when they advertise on TV,

38

00:06:28.040 –> 00:06:38.730

Jeffrey LeBlanc: this is what they show. I mean, these are bad accidents, and they they’re warning their clients to think that every automobile accident is like this and next slide.

39

00:06:39.020 –> 00:06:42.289

Jeffrey LeBlanc: And more likely it’s just one of these.

40

00:06:42.310 –> 00:06:54.150

Jeffrey LeBlanc: and I’m watching the folks coming through the chat. They have people all over the all over the place, from Texas and Ohio and Florida, inside and Southern party United States. But most the accidents that we deal with on a daily basis.

41

00:06:54.180 –> 00:07:09.890

Jeffrey LeBlanc: or the minor parking lots, you bumping somebody at a a little fender vendor at a red line or your back and out. You’re back in someone’s park car. That’s probably 90% of what we deal with as far as from our agency side of things.

42

00:07:09.910 –> 00:07:18.350

Jeffrey LeBlanc: It used to be a simple process, but it seems like now in the auto industry in the insurance world it’s got a lot more complex.

43

00:07:18.430 –> 00:07:35.789

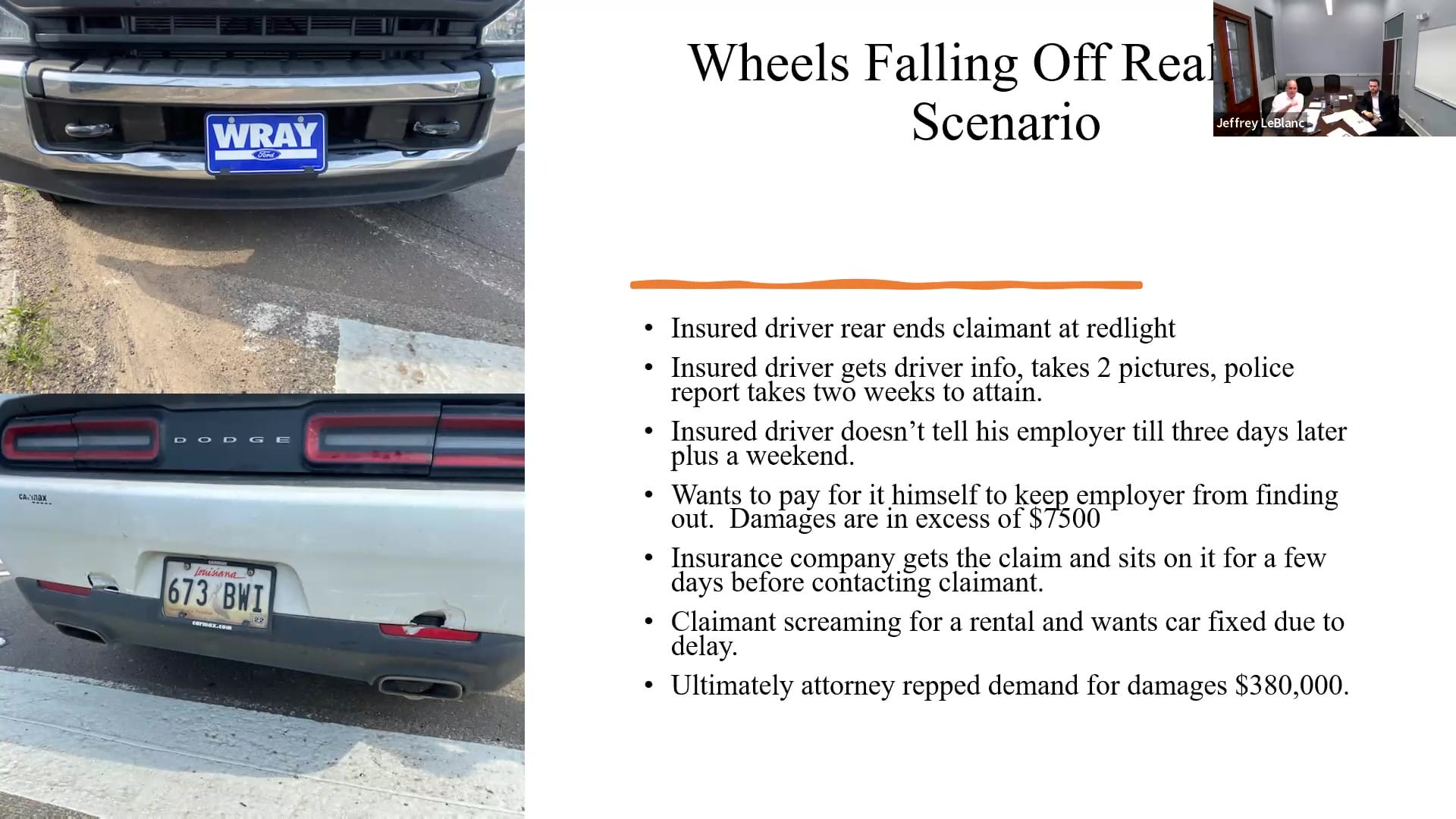

Jeffrey LeBlanc: There’s 2 pictures over on the right. We’ll talk about this one specifically. I’ll call this the the guy that I know, the gentleman that drive the truck name is Colt and Colt had a boo boo! And we’ll get a little bit deeper to that as we get further on down the line is turned into quite a little bit interesting. Claim for us. Slide, please.

44

00:07:36.780 –> 00:07:40.229

Jeffrey LeBlanc: So whenever they do these advertisements

45

00:07:40.540 –> 00:07:52.519

Jeffrey LeBlanc: by the by, the plaintiff attorneys, if they show the injuries in. Granted. I’m not making light any way, share before there are people that are average that are hurt as a result of an automobile accident.

46

00:07:52.550 –> 00:08:16.249

Jeffrey LeBlanc: But the parking lot accidents that was basically just a minor fender vendor. They have a process. These plaintiff attorneys have a process to go through in order to make a claim against the insurance companies, and they have the medical bills, and they require surgery, and they have neck pain. And all these new things down, bottom right hand is the traumatic brain injury. That’s that’s kind of the hot button right now.

47

00:08:16.310 –> 00:08:29.889

Jeffrey LeBlanc: But it it goes for a little minor hiccup of I’m sorry to next thing you know, there’d be $200,000 worth of worth of surgery to repair a 5 mile an hour accident. But that’s $1,000 for the damage to the vehicle next slide, please.

48

00:08:31.040 –> 00:08:36.320

Jeffrey LeBlanc: So I went down a rabbit hole one evening, and I started looking to see what the advertising dollars were spent.

49

00:08:36.380 –> 00:08:51.590

Jeffrey LeBlanc: and I don’t know if we have people on this for many people on this webinar from any of these States. But look at the amount of money and the amount of ads that are that are run. But if you got the total amount, plus the number of ads that are running each state.

50

00:08:52.190 –> 00:09:01.609

Jeffrey LeBlanc: That’s an entirely large amount of money. And my response, Luke, we got to laugh. And about when I sent it. I said, Man, they’re spending that much money and advertising.

51

00:09:01.720 –> 00:09:13.179

Jeffrey LeBlanc: They’re making that much money, and it’s all come down your insurance premiums. Okay. Everybody wants to know. Seems like the hot button. Our office is my auto rates keep going up. Auto rates keep going up.

52

00:09:13.310 –> 00:09:22.419

Jeffrey LeBlanc: This is direct link to why it’s going up because they’ve got to cover their costs, and then they get the collections, and you know they’re like I said they should visit it. They’re making it

53

00:09:22.440 –> 00:09:27.500

Jeffrey LeBlanc: next slide, please. Then I went down a deeper rabbit hole.

54

00:09:27.550 –> 00:09:40.390

Jeffrey LeBlanc: This is just Louisiana. We’re one of the most I mean. I’m born and raised Louisiana. I love my state. We’re one of the most litigious States that we that out there, if not number one, was that fair to say? Loop, as far as

55

00:09:40.640 –> 00:09:42.730

Jeffrey LeBlanc: that’s absolutely fair. It’s

56

00:09:42.760 –> 00:09:52.570

Jeffrey LeBlanc: highly litigious. I think it’s, you know. Pardon me. but it’s been considered a judicial hellhole by multiple companies and

57

00:09:52.690 –> 00:10:17.060

Jeffrey LeBlanc: groups that track that kind of thing. It’s absolutely, incredibly, as as business, friendly as the politicians want to set it. We are, and sometimes it’s a struggle, because there, right now, we’re having some struggles with some of our insurance companies are pulling out because it is so. But what’s really interesting is, it’s a quarter 4 for 2020. There was

58

00:10:17.260 –> 00:10:39.820

Jeffrey LeBlanc: 3 million advertisement for 237 million, and then the total gross domestic product for Somalia was 444 million. So that’s just an eye opening amount, I mean, would you agree with that, Steve and Mark? Yes, and that these numbers are 2020, I can assure you those numbers are trending up into the right

59

00:10:40.800 –> 00:10:46.509

Jeffrey LeBlanc: Yup, and then, you know, top law firms, I mean Dudley DeBossier. They are the official

60

00:10:46.980 –> 00:11:09.529

Jeffrey LeBlanc: playing or injury attorney for LSU football. That’s their new thing. They’re hanging back. And also, I think they’re doing the Saints. And I’m like, How did how do we go from professional college football to being attorney, and that’s just the way the world’s going. And I give them credit. They’re master marketers, cause I know they can make the money, and that’s their master marketers, and they’ve got, you know. At 1 point Gordon McKernan, I heard the

61

00:11:09.560 –> 00:11:18.149

Jeffrey LeBlanc: I heard the number out there that he was spending close to half 1 million dollars a month just in billboard advertising. And that is crazy amount of money. Next slide, please.

62

00:11:19.300 –> 00:11:22.900

Jeffrey LeBlanc: Okay, so we’re gonna get in the meat and potatoes. Phase of this

63

00:11:23.030 –> 00:11:32.579

Jeffrey LeBlanc: one of the things I like to ask my customer when I sit down with them. And even guys that are established, and or new customers. Are you a lucky company, or are you a good company?

64

00:11:33.060 –> 00:11:39.119

Jeffrey LeBlanc: And they kind of look at me. What do you mean by that? We could be a great company and never, ever have

65

00:11:39.300 –> 00:11:53.269

Jeffrey LeBlanc: the big one? But, statistically speaking, if you’re if you’ve got fleet of vehicles at some point you’re gonna have a a pretty significant automobile accident, and you need to be prepared for that automatic.

66

00:11:53.380 –> 00:12:03.270

Jeffrey LeBlanc: or you just been lucky. And you’ve never had it. And are you prepared for that scenario? You have to ask yourself that question next slide, please.

67

00:12:05.430 –> 00:12:09.590

Jeffrey LeBlanc: Alright. Luke and I sat down and laughed about this because it’s it.

68

00:12:09.650 –> 00:12:12.770

Jeffrey LeBlanc: These I call these the truism of auto claims.

69

00:12:12.940 –> 00:12:19.039

Jeffrey LeBlanc: If these plans attorneys are spending that much money advertise and talk about that. They’re making that much money on advertising.

70

00:12:20.500 –> 00:12:31.779

Jeffrey LeBlanc: working in the insurance industry for so many years. It’s kind of truism that their thought process is always, if you throw money at it, it’s gonna go away.

71

00:12:31.870 –> 00:12:48.760

Jeffrey LeBlanc: Well, the problem is, yeah, that works. But there’s mentality that’s been formed in society, that if I can get an automobile accident. I can make some money and by throwing money and trying to make it go away it’s cost challenges, because these.

72

00:12:49.430 –> 00:13:09.199

Jeffrey LeBlanc: settlements keep getting larger and larger and larger. Across the board, and Luke can kind of add a little color to this in terms of these don’t generally like to take auto claim to trial in front of jury. Is that is that fair to say Luke? No, that’s absolutely true. And it’s gotten. It’s gotten a lot worse, especially since Covid. We’ve seen

73

00:13:09.450 –> 00:13:22.199

Jeffrey LeBlanc: Covid. And then inflation have really started to skyrocket jury awards. Even for minor claims. In this area alone there was a recent 49 million dollar verdict.

74

00:13:22.210 –> 00:13:30.060

Jeffrey LeBlanc: I think there was another one north of 50, about little under a year ago. It’s it’s really just kind of taken off.

75

00:13:30.090 –> 00:13:36.520

Jeffrey LeBlanc: So insurance companies do not want to be in front of juries. They’re scared of juries, which and I understand that

76

00:13:36.700 –> 00:13:46.189

Jeffrey LeBlanc: the problem is as Jeff’s mentioning when you start throwing money at a problem. Eventually, it’s gonna cost more and more and more money to make that problem go away.

77

00:13:46.750 –> 00:13:56.160

Jeffrey LeBlanc: sure. And then, with some people don’t know like we, I’ll go back to Gordon McKernan. He’s a big attorney out of Baton Rouge that over the last,

78

00:13:57.180 –> 00:14:06.009

Jeffrey LeBlanc: I don’t know, I’d say last 5 or 10 years that parents say you think they figured out that, hey? We can make a lot of money on these large

79

00:14:06.070 –> 00:14:17.169

Jeffrey LeBlanc: these large insurance claims. And so the private equity money that was out of out of New York state. They’re like, Look, we’re we’re taking. We’ve got a large amount of assets

80

00:14:17.350 –> 00:14:24.820

Jeffrey LeBlanc: we’re putting in the stock market here investing it, and they’re making a return of I don’t know 7 to 12% on a good year. Kind of thing.

81

00:14:24.880 –> 00:14:38.749

Jeffrey LeBlanc: Well, they’ve reached out to several, and this is another. This is happening in Dallas as well. Some of the larger, plaintive attorneys. And they’re saying, Hey, we’ll back you. Because in order to take a in order to take a a, a claim to trial.

82

00:14:39.070 –> 00:14:50.350

Jeffrey LeBlanc: I mean minimum. 6 figures. Is that fair to say? I agree with that. If you go through all discovery, you take the depositions you do. The red discovery motions, pretrial motions, dispositive motions

83

00:14:50.810 –> 00:15:11.949

Jeffrey LeBlanc: week, long trial, maybe some post trial motion degrees. Yeah, I think it’s it’s about, I usually quote between 75 low end, and 6 figures. Yes, 6 figures. So for a for a law firm to front that money that’s that’s huge on their capital. Well, so the private equity firms come in and say, Hey, we’ll front this money because we know

84

00:15:11.990 –> 00:15:29.750

Jeffrey LeBlanc: that we can. You’re gonna win this case. There’s about 80% chance you’re gonna we’re gonna get something out of the deal, and so they may take it and and and invest a hundred grand. But then they get a hundred-thousand judgment on it. Well, they just tripled, quadrupled, whatever the number may be after expenses.

85

00:15:29.750 –> 00:15:50.749

Jeffrey LeBlanc: and they’re making a calendar on this. I know there’s several, South Louisiana said. There’s a big law firm out of out of Dallas that I know. It is one of the long view. There’s a couple out of that Little Rock that I’ve heard that have been back by private equity money. So if you’re aware of that, that’s what’s driving a lot of this advertising because it’s a corporation. This is a corporate.

86

00:15:50.770 –> 00:15:55.929

Jeffrey LeBlanc: a corporate money-making process is what it is, and they figured it out next slide, please

87

00:15:57.180 –> 00:16:04.510

Jeffrey LeBlanc: alright. So this is really the nuts and bolts of what we’ve kind of put this thing together on. Here’s the playbook.

88

00:16:04.910 –> 00:16:24.060

Jeffrey LeBlanc: Everyone’s hurt, no matter if you hit him on 5 miles an hour. You hit him on 50 miles an hour. Everyone’s hurting. Everybody needs an attorney, and people consistently get rich. It’s attorney, if you like. I’m friends with attorneys on both the defense and the plaintive side, and they’ve got lots of toys because they work real hard through money, and they make they make a decent living.

89

00:16:24.090 –> 00:16:30.690

Jeffrey LeBlanc: Most of these plaintive attorneys like there’s one down street that we we deal with all the time. Personally.

90

00:16:30.710 –> 00:16:32.070

Jeffrey LeBlanc: he’s got

91

00:16:32.370 –> 00:16:52.450

Jeffrey LeBlanc: an agreement. Is that a fair statement? I have to watch what I say here. It’s an agreement with a doctor that they’ll oh, we need to get seen about a medical doctor. Let me hook you up with Doctor X, and how that typically works. Yeah. So that’s I don’t want to get too much into what’s coming later. But that’s

92

00:16:52.500 –> 00:17:03.219

Jeffrey LeBlanc: the biggest development that we’ve seen. I just wanna loop back real quick what Jeff is saying. The days of plaintiff lawyers being Wild West Bandito’s is that

93

00:17:03.500 –> 00:17:31.460

Jeffrey LeBlanc: they are serious corporate actors, and they’re trying to make money, and they do a good job of it. At least I will share that. I interviewed with one. I saw someone say that Texas Hammer exactly. I interviewed with one of the firms. I won’t say which one, and they shared with me that they had just bought outright the marketing company that they had been using is they’re making so much money. They brought them in house to just their work.

94

00:17:31.680 –> 00:17:42.520

Jeffrey LeBlanc: And so what you have to understand is, these people all go to conferences throughout the country, and they learn the new strategies, and the most recent one is what Jeff has there on number 2

95

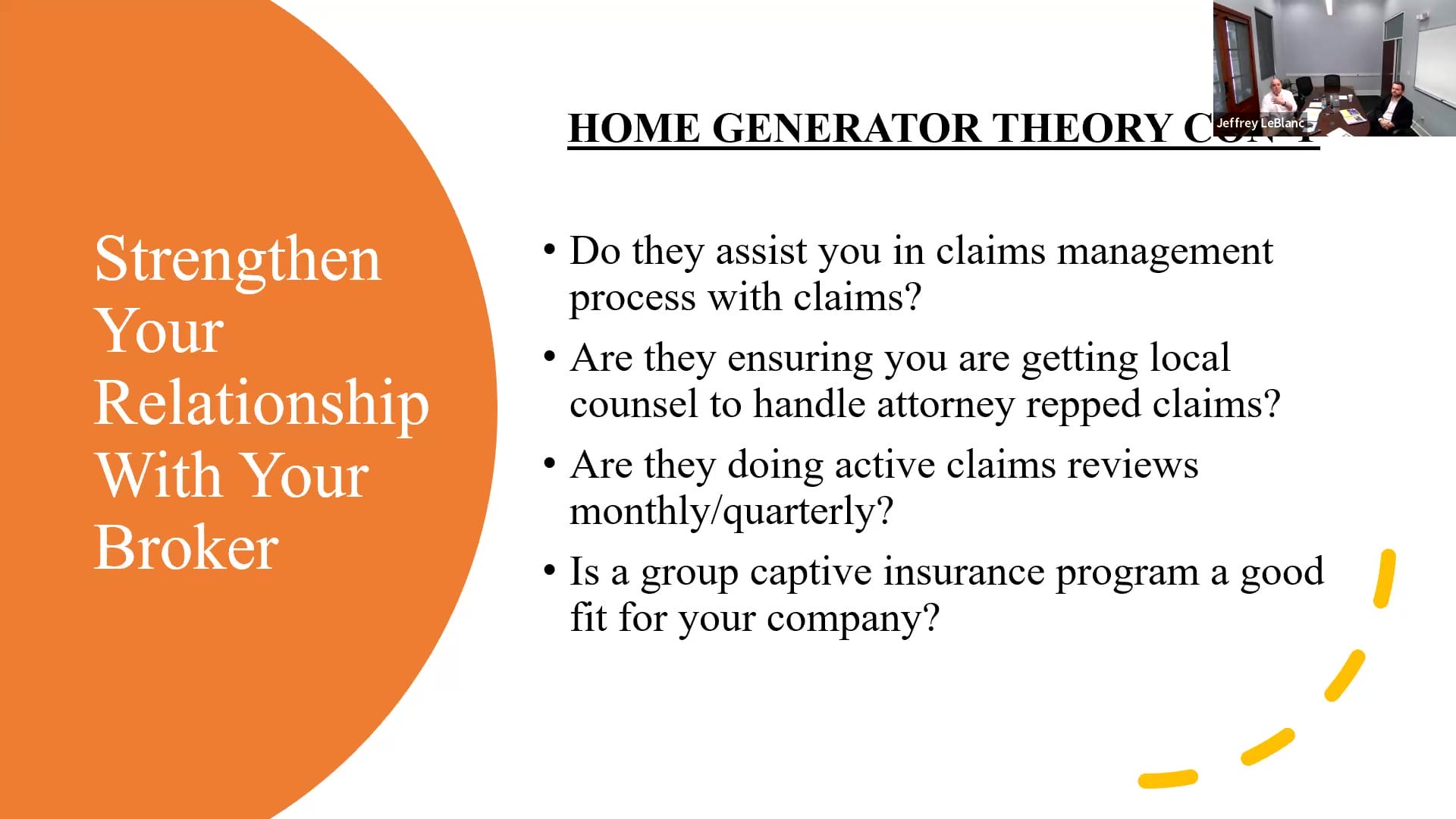

00:17:42.840 –> 00:17:47.650

Jeffrey LeBlanc: juries don’t like lawyers. Most people don’t like lawyers to be fair, so don’t blame jurors.

96

00:17:47.720 –> 00:17:55.050

Jeffrey LeBlanc: but juries like doctors. So what plant lawyers have done is they found these doctors.

97

00:17:55.420 –> 00:18:06.259

Jeffrey LeBlanc: and I don’t. I’m not miss merging anyone, but they have found doctors who are more agreeable to their proposed long-term plans of treatment.

98

00:18:06.270 –> 00:18:21.650

Jeffrey LeBlanc: And so a jury is not going to give huge general damages because a lawyer asked, but a jury will give huge special damages of medical records of a doctor says so. So that’s kind of the trend that we’ve seen recently

99

00:18:21.730 –> 00:18:34.229

Jeffrey LeBlanc: like when I was doing claims adjusting here in Shreveport there was one particular plaintiff attorney, and he would send every one of his clients to a certain chiropractor here in town.

100

00:18:34.360 –> 00:18:58.000

Jeffrey LeBlanc: and it almost became a joke where, when I get a letter of rep with you and I became friends with the attorney and I call him up and said, Okay, I bet you lunch that the doctor’s bills we’re going to be between $2,500 and $2,900. It’s like, How do you know that, Jeff? Will you take the previous 10 folks that you sent to him? And I hold the bills up to them. They’re exactly the same in the report, exactly the same, except for they change the name on it.

101

00:18:59.100 –> 00:19:07.629

Jeffrey LeBlanc: I don’t believe in coincidences, but it and we kind of like I said it became a I buy you lunch, you buy me lunch. We were just trying to get through the process, and so

102

00:19:07.890 –> 00:19:20.270

Jeffrey LeBlanc: there’s certain agreements and arrangements that are out there, and and they fill in the blank for the lawsuits as well. And you know, that’s fair to say a lawsuit. They’re already pre-built, ready to go, and they all read the same. These

103

00:19:20.320 –> 00:19:41.650

Jeffrey LeBlanc: these 5 attorneys are going out ridiculous settlements request, and they just want to see what happens. And Mark and Steve and I were talking about that. We’re in Texas. It seems like they’re they just demand policy limits. I mean, though, demand out they’re just gonna go for a policy limits and see what happens. And loose tact is is to go. No, I need a demand. What number we whatever we talking about

104

00:19:41.680 –> 00:19:48.659

Jeffrey LeBlanc: and kind of go from there? They’ll file suit. They fill the names, and they’re all pre-built

105

00:19:49.090 –> 00:20:01.230

Jeffrey LeBlanc: Now, with the new tech that we’re seeing is, we received a lawsuit sitting on my desk upstairs probably 3, 4 months ago, and there was 43 pages worth of discovery.

106

00:20:01.360 –> 00:20:20.350

Jeffrey LeBlanc: and when I’m telling you it is everything from the gas receipts at the pump to whether or not you put air in the tires in the truck to where was the guy working, you know, 12 years ago? I mean, it’s literally designed to overwhelm the defendants with a request for information.

107

00:20:20.350 –> 00:20:34.059

Jeffrey LeBlanc: And then you tax with Steve mentioned, or Mark mentioned about the raptor. They’ve got the raptor. Was the deposition, and then they’ve also got. Yeah. The reptile theory that’s

108

00:20:34.060 –> 00:21:02.629

Jeffrey LeBlanc: is that change a little bit from the reptile. It moves around a lot. But as I mentioned earlier, these kind of lawyers all go to the same seminars. They all learn the same thing. There are these, this is not a joke. There are these special books on these strategies that you’re not allowed to buy unless you’re planning. You have to literally prove your plan, for in order to get one. But it’s it’s something as minor as I won’t get too deep into it for these depositions. They’ll say

109

00:21:02.680 –> 00:21:16.260

Jeffrey LeBlanc: to the opponent, which is usually a corporate rep, hey, safety is important, right? And of course you answer, yes. Then they take a step further. Okay, so safety is the most important thing, and everybody wants to give a good answer, and so they say yes.

110

00:21:16.340 –> 00:21:35.950

Jeffrey LeBlanc: and then again, I won’t get too deep into. They just spirals from safety is the most important thing to you’ve done everything wrong, you do not take safety is the highest priority. Thus this person is in here does pay me $100,000, and that can be overcome, but it requires a lot of work, both from the attorney side and from the insurance side.

111

00:21:36.990 –> 00:21:43.769

Jeffrey LeBlanc: And then the final thing there is, go to trial or settle. I had a conversation with the attorney of South Louisiana, and

112

00:21:43.930 –> 00:21:49.720

Jeffrey LeBlanc: liability was clear cut. I’ve worked lots of claims with this guy. He helps us out. A lot of workers come a lot of auto claims.

113

00:21:50.200 –> 00:22:06.359

Jeffrey LeBlanc: and I was talking to John, and he said liability was clear cut on this deal. We had a pretty good amount of insurance. We had one primary, we had 10, we had 16 set up there, total as far as coverage, and it was a really bad plan, and we knew

114

00:22:06.390 –> 00:22:14.739

Jeffrey LeBlanc: that we were gonna like policy limits. There was no doubt. I mean, there was fatality involved, serious injuries, and all, we had 16.

115

00:22:14.950 –> 00:22:28.430

Jeffrey LeBlanc: So basically, the attorney, our attorney called said, Hey, we’re ready to write a check. Let’s get this thing done. And the attorney said, absolutely not. I take every trial to claim every trial, every claim trial.

116

00:22:28.850 –> 00:22:38.469

Jeffrey LeBlanc: And he said, Why is it always got 16 in the attorneys? Response, the plan. Attorney’s response is, I can get more in front of a jury.

117

00:22:38.730 –> 00:23:07.430

Jeffrey LeBlanc: It all only wound up settling for 16 million. But it was. I think it was more. We’re gonna take it and try to make a precedence and see if we can get 20 or making up a number and see if we can get more, and maybe we can dig into the owners pockets on a on a punitive side of things. But I don’t. I think it wound up they negotiated it and wanted to pay a little bit, but ultimately just it wound up, settling for the for the policy limits next slide.

118

00:23:11.560 –> 00:23:19.389

Jeffrey LeBlanc: Okay. put this together because it seems like I even talked to the folks that they’ve been doing this for a long time.

119

00:23:19.500 –> 00:23:34.429

Jeffrey LeBlanc: and then back in the fifties and sixties and seventies. Hey? I bumped into your car. Let me pay for your damages and people, you know, for the insurance people were self insuring themselves, and it’s just kind of the way it was. They always bought insurance a lot of times. It wasn’t very expensive, so they would just pay for it.

120

00:23:34.650 –> 00:23:45.220

Jeffrey LeBlanc: Well, then, it kind of evolved to. I’m sorry I bumped into your car. Let me get you my insurance information, and that was seventies, and these kind of standard practice. And people were like, Okay, just take care of a car. But I’m going to be good.

121

00:23:45.580 –> 00:23:47.270

Jeffrey LeBlanc: Well, I started working

122

00:23:47.400 –> 00:24:03.549

Jeffrey LeBlanc: in 19. I started working claims in 1990. Maybe. There’s an insurance. Here’s intern insurance information. Let me take care of your car. And now you’re injured. Even then we’re talking about a minor accident here.

123

00:24:03.630 –> 00:24:30.019

Jeffrey LeBlanc: Let me take care of your Bible entry claim. So the the insurance companies were right. Check for the damages, and then they write a bottle entry claim. Well, then, this is evolve and kind of got. The plate of attorneys got involved with the the corporate side of things. Here’s my insurance information. I need to get my car taken care of my model, the injury claim. I’ve got a loss of use, my rental loss of wages, and it didn’t value the claims, and that just seems to really blow it blown up

124

00:24:30.080 –> 00:24:36.260

Jeffrey LeBlanc: from 2000 to 2010 middle of middle of 2000. Now.

125

00:24:36.290 –> 00:24:58.940

Jeffrey LeBlanc: you know, we’ll bump into somebody 8 0’clock in the morning by 8:45, and the police literally haven’t let the scene and they’ve already called. They’ve already called the plane as attorney, and by the end of the day, with a traumatic brain injury, middle language, loss of consortium. PTSD, that’s the new one, too. Right? Traumatic brain. And PTSD, that’s the hot buttons right now. And then. The oh, I need back fusion surgery. But the real

126

00:24:59.020 –> 00:25:23.359

Jeffrey LeBlanc: thing that is really really taken off is these long term injections. And I’m gonna let loop just a little bit as far as talk a little bit about that. Yeah, we’ll get to deep into it. But one of these things that the plan of lawyers have picked up is what’s called a Life Care plan. They get Life Care planners, which is basically somebody who will take your plaintiff and say, okay, the plan is gone and gotten

127

00:25:23.650 –> 00:25:44.890

Jeffrey LeBlanc: chiropractic treatment. Pt, conservative treatment. And now they’ve had one to 2 what’s called ESI’s girl steroid injections or ablations basically, well, getting to even the week. It just is more treatment for the back which you can get between one to 4 times a year.

128

00:25:45.130 –> 00:25:56.650

Jeffrey LeBlanc: What the Life Care Planner does is, they said cool, based on that. You’re gonna need this every year for the rest of your life, and I calculate you will live X number of years.

129

00:25:56.730 –> 00:26:01.849

Jeffrey LeBlanc: And so I don’t see a Life Care plan case for less than a million dollars

130

00:26:02.840 –> 00:26:03.660

Jeffrey LeBlanc: ever.

131

00:26:04.230 –> 00:26:08.679

Jeffrey LeBlanc: Well, okay. But thank you, Luke. So next slide.

132

00:26:09.670 –> 00:26:22.529

Jeffrey LeBlanc: So I put together the perfect world scenario, and actually had one of these happen Monday morning. I mean, it was a little minor fender vendor where the insured vehicle rearrange the plane would be able minor damage 8 o’clock on there all the way to work

133

00:26:22.710 –> 00:26:43.340

Jeffrey LeBlanc: no injuries. I got damaged to my bumper. I got no damage to the insured vehicle. The insured driver gets out courteous to the courteous to the driver. Hey? I’m sorry I bumped you at the bank parking lot. Let me get your let me exchange interns information with you, went ahead and call the police to get a report per standard company policy

134

00:26:43.340 –> 00:26:59.599

Jeffrey LeBlanc: injury driver gets out, he takes pictures, gets it’s all the documentation and gets good contact information on the claimant. He didn’t. Just he or she didn’t just sit in the car and wait for the police to get there. We’ll go down that rabbit hole in just a second. Okay? The answer report was reported. Police.

135

00:26:59.600 –> 00:27:14.309

Jeffrey LeBlanc: The employer immediately calls employer and says, Hey, I’ve bumped into Suzy. Here’s your information. Got minor damages. I’ve got good pictures. The police write the report, and then, next thing you know, it’s the the police report will be ready in 24 h.

136

00:27:14.420 –> 00:27:20.630

Jeffrey LeBlanc: That’s not happening nowadays. It seems like it’s really changed. The employer immediately gets all the information.

137

00:27:20.710 –> 00:27:48.669

Jeffrey LeBlanc: He reports it to the insurance carrier, the broker, or the directly reports to the agent. It’s assigned to an adjuster, and then by the end of the day the claims adjuster has made contact. We’ve got them set up to go to the shop. We got them set up with a rental. There’s no, they confirm. There’s no injuries, liabilities, clear cut. Should the claim it takes to the body shop to get an estimate. They upload it. And then, you know, payments issue later that week, and it’s mailed to the claimant.

138

00:27:48.960 –> 00:28:03.299

Jeffrey LeBlanc: The chances of this happening is probably less than about 5%. Nowadays. It seems like couple of things that’s going on is like the police. You know. I’ve been working with Shreveport police for years. We used to be able to get police reports turned around in within 24 to 48 h.

139

00:28:03.300 –> 00:28:28.269

Jeffrey LeBlanc: Now for some. They they computerized it, which was supposed to make it more efficient. And now it’s taking 7 to 10 days. Hmm, so it’s doesn’t make any sense. Claims adjusters. What we’re seeing from the claims adjuster side. There was a big turnover and in in claims, gestures as far as knowledgeable claims adjusters leave in the industry during Covid. So you’ve got a lot of inexperience on

140

00:28:28.270 –> 00:28:37.900

Jeffrey LeBlanc: claims that they’re trying to get 14 days, 6 months in Houston. Yep, if you go to the Louisiana State Police it’ll take 4 months

141

00:28:38.010 –> 00:28:48.960

Jeffrey LeBlanc: to get it to get a losing State police report depending on how fast they process it. But get back to what I was saying, we’ve just noticed that there’s a lot of innocent inexperience claims adjusters, and

142

00:28:49.790 –> 00:29:04.989

Jeffrey LeBlanc: I was one for 15 years. Claims adjusters are overworked, underpaid, and overwhelmed, and they might have 200 files sitting on their sitting on their desk, and they just can’t flip them as fast as they used to. Next slide, please.

143

00:29:06.580 –> 00:29:28.030

Jeffrey LeBlanc: So a real life auto accident, I mean, this is a true, you know injury driver ruins claim it less $1,500 would damage to places call and you may be exchange information. We we talked to our our, we talked to our clients about what, and try to teach their guys what to say how to say it, when to say it that kind of stuff, and wait for the report to be ready. What the problem is

144

00:29:28.620 –> 00:29:54.800

Jeffrey LeBlanc: the business might wait 3 or 4 days. They’ll get whatever information they have, and they might take one or 2 pictures. And then they’ll wait 3 or 4 days to report, and then they call the agency or or the company the claim adjuster gets it. They sit on it 48 h before they make a call, and chances are the claimant becomes frustrated because they there’s a big misnomer out there, in the general public that they think that they were involved in an accident

145

00:29:54.800 –> 00:30:18.279

Jeffrey LeBlanc: that the police are gonna call the insurance company report the claim for you. It doesn’t. That doesn’t work that way. It’s never worked that way in the 20 something years I’ve been working in the insurance world that’s always been this big misnomer that’s sitting out there that oh, please should have recorded it. No, you need to teach your folks. They have to let you know. The faster they let you know the better it’s gonna be next slide.

146

00:30:19.650 –> 00:30:32.929

Jeffrey LeBlanc: So know that the the the claim clock is ticking. The first insurance company that I’ve worked for was Progressive for about 5 and a half years Progressive was a big deal for them, and I will get their credit. They figured it out

147

00:30:33.210 –> 00:30:48.550

Jeffrey LeBlanc: the faster you get it reported, the faster you start, cut, and checks, the more likely that claim is going to settle faster and for less expenses. It would. If you just sit on a twill your thumbs and also they’re less likely to seek legal advice

148

00:30:49.670 –> 00:31:13.109

Jeffrey LeBlanc: changed a little bit because people are so geared and marketed that they have to go in an attorney if they have an automobile accident. We saw that in previous slides the amount of marketing is out there. But they’re still, if you have the opportunity to get a vehicle looked at their injury. Taken care of. If they’re written care of. Statistically, it’s gonna change. It’s gonna close a lot faster next slide.

149

00:31:14.360 –> 00:31:23.459

Jeffrey LeBlanc: Okay, this was the we’re circle back to the picture. This is the call claim I know. Call personally to good Guy, so he’s a kind of contractor that I work with.

150

00:31:23.980 –> 00:31:27.689

Jeffrey LeBlanc: He is sitting at a red light.

151

00:31:28.950 –> 00:31:38.859

Jeffrey LeBlanc: he said. The red light. The minor little small little town over here, about 30 miles east to here, and he bumps into a the car in front of it.

152

00:31:39.710 –> 00:31:44.559

Jeffrey LeBlanc: Well, he thinks his employer is going to be mad at him, so he doesn’t report the claim.

153

00:31:45.100 –> 00:32:00.599

Jeffrey LeBlanc: And he said, tells the guy, Hey, man, I’m gonna take care of this for you. Don’t worry about it. I got this covered. So he gets a little bit of information from the gentleman because they he’s gonna pay for it out of his pocket, he said. He takes work he takes to. These are the 2 pictures he took.

154

00:32:00.680 –> 00:32:03.020

Jeffrey LeBlanc: We’ve got the front of his car and the back of his car.

155

00:32:03.320 –> 00:32:23.350

Jeffrey LeBlanc: The police report takes about 2 and a half weeks. What was pretty pretty interesting was there was police officer that was sitting across across across from the accident, actually saw the accident happened. He didn’t even want to write a report upon it, but the claimant insisted on it. Actually, our guidelines, that’s company policy took about 2 or 3 weeks to get get our get our report.

156

00:32:24.300 –> 00:32:33.069

Jeffrey LeBlanc: The the climate waited. I don’t know. 2 or 3 days went and got an estimate for the estimates for $7,500.

157

00:32:33.250 –> 00:32:34.240

Jeffrey LeBlanc: Well.

158

00:32:34.360 –> 00:32:42.949

Jeffrey LeBlanc: this guy’s an A/C technician. He just doesn’t have 8 grand is kind of laying around in his pocket, and so he goes back and kinda had his head

159

00:32:43.160 –> 00:32:47.350

Jeffrey LeBlanc: head, Dad, and talk to the business owner and said, Hey, I bumped into somebody.

160

00:32:47.600 –> 00:33:03.979

Jeffrey LeBlanc: Bumped into somebody, and there was no damage. Well, you all can see very clearly right there. There’s actual damage to this vehicle, and it did damage to the bumper, the the rebar of the absorber accident. So there’s a lot of hidden damage on this thing, and

161

00:33:04.020 –> 00:33:27.069

Jeffrey LeBlanc: so we sat down, and we it took about 10 to 12 days before we actually knew about the claim. After everything was said and done well, the claimant calls our office screaming at the top of his long. He needs a rental, and he’s mad at the delay. Well, ultimately this thing we got demand for it. That was they’re asking for almost three hundred and eighty-thousand for this.

162

00:33:27.240 –> 00:33:36.799

Jeffrey LeBlanc: So this is a real live wheels falling off the employee was trained on what to do.

163

00:33:37.010 –> 00:33:49.740

Jeffrey LeBlanc: He knew what to do, and went over the scenarios a gazillion times with our training he was scared because he thought he was in getting trouble with his employer. One of the things when I talk to him. When I talk to my guys.

164

00:33:50.250 –> 00:33:53.030

Jeffrey LeBlanc: guys, what’s done is done.

165

00:33:53.140 –> 00:34:05.179

Jeffrey LeBlanc: If if you bump into somebody I need to know about it because it it yes, bleeding is happening, but it needs to stop the bleeding faster rather than later. This thing probably could have could have been

166

00:34:05.260 –> 00:34:26.099

Jeffrey LeBlanc: mitigated a lot faster, but because he sat on it and sat on it, sat on it. It’s gotten out of control, and we have no control of the client, we literally reacting to everything. Now versus being proactive. Or do you see a lot of these what you tell me your experience as far as when you get situations like this.

167

00:34:26.100 –> 00:34:39.850

Jeffrey LeBlanc: So, I’ve seen it both ways, and I’ve actually seen them both ways this week. I have one client. It’s a large commercial carrier, incredibly proactive. All of their employees know if there is any accident at all.

168

00:34:40.139 –> 00:34:49.509

Jeffrey LeBlanc: You let them know immediately. They let the insurance company know immediately. They let me know immediately, and then we better build investigator, and then I’m on it. I’m running it. Which, by the way.

169

00:34:50.030 –> 00:34:59.570

Jeffrey LeBlanc: you want that you want an attorney involved, because there’s a strong argument that a lot of the stuff that gets discussed then is protected and doesn’t come out and discover.

170

00:34:59.850 –> 00:35:06.260

Jeffrey LeBlanc: But I understand not everybody can do that. But the thing is, when an employee hides a wreck

171

00:35:06.550 –> 00:35:17.809

Jeffrey LeBlanc: and a lawsuit is filed. Here’s the conversation that I then have with the adjuster who gives me the file. I said, Okay, we got the petition. What what else you got for? What do we know about this lead? Just says I’ve got nothing.

172

00:35:17.840 –> 00:35:21.079

Jeffrey LeBlanc: What do you mean? You have nothing. I just found out about this claim today.

173

00:35:21.520 –> 00:35:31.360

Jeffrey LeBlanc: Okay, what do you want me to do about this? I don’t know. And then we have to go through discovery. There’s no chance of an early resolution. I don’t have all the facts on the front.

174

00:35:32.120 –> 00:35:34.760

Jeffrey LeBlanc: Okay, next next slide, please.

175

00:35:35.590 –> 00:35:38.459

Jeffrey LeBlanc: So here’s some strategies we came up with.

176

00:35:38.700 –> 00:35:58.700

Jeffrey LeBlanc: If you’re not having a conversation when you have those toolbox talk, or you have those drivers meeting, and you’re not actively going over with your drivers what to do when they have an accident. You’re doing yourself a disservice. Okay? And and it doesn’t have. You don’t have to be Sherlock Holmes. I just need some basic pictures.

177

00:35:58.700 –> 00:36:11.210

Jeffrey LeBlanc: some basic information. And inevitably, whenever I get get pictures from these from these guys or folks that are driving. I will get 200 pictures, literally of a headline.

178

00:36:12.350 –> 00:36:37.409

Jeffrey LeBlanc: I don’t care about the headlight, the headlice, 400 bucks. It is what it is. I need you to take a picture of the front of the car, and you take a picture of the side of the car, and you take picture of the corner of the car. Take a picture all 4 corners because a it helps me understand what kind of car it is, what the license plate is. If you can get a picture of the ven. That’s great. But it gives me the whole picture. Take a picture of the intersection. Take a picture of the parking lot.

179

00:36:37.410 –> 00:36:50.560

Jeffrey LeBlanc: But inevitably I’ll get 10-15 pictures of the damage great, the damages, or what they are really don’t care on the grand scale of things. They’re really gonna be $1,500, $5,000 but backup and give me a bunch of pictures.

180

00:36:51.080 –> 00:37:07.980

Jeffrey LeBlanc: Everybody has a phone in their pocket. It costs you nothing to take a picture. Years ago we used to provide our clients with little disposable Kodak cameras and everybody. We keep them in their dog on a glove box. Don’t do that anymore. Everybody’s got a camera. It doesn’t cost a single dime to take a picture.

181

00:37:08.090 –> 00:37:14.570

Jeffrey LeBlanc: documentation is key because the plane attorneys are gonna ask for everything.

182

00:37:14.700 –> 00:37:42.870

Jeffrey LeBlanc: Get those drivers to write down what happened? Not on one sentence or 2 sentences. I bumped into Suzy at the at the at the at the parking lot. I need a detailed what were you doing where we headed which direction you were going? You wanna lock those drivers in a really good story because one of the things. And I tell my folks guys, if you’re at fault, we talk about. If you’re at fault, I need to know about it, because that way I can defend you

183

00:37:42.890 –> 00:37:59.130

Jeffrey LeBlanc: from the moment that it happens versus sitting there in a deposition, and it’s happened where the driver all of a sudden changes his story in the middle of a dog on deposition. And we’re like holy start. Our whole defense just went out the window.

184

00:37:59.300 –> 00:38:04.720

Jeffrey LeBlanc: And so it it’s real, real, real sensitive to something like that happens.

185

00:38:05.840 –> 00:38:33.349

Jeffrey LeBlanc: folks, if you’re running a fleet, be organized. Have one or 2 people in your office that’s responsible for gathering data. These plaintiff attorneys are asking for everything. If you’re running on making up a number. If you’re running 25 trucks, and you’ve got 25 units every one of those vehicles should have a file, you know. Unit 1, 2, 3, 4. Every time you all do something that truck with us all change, or you know, A/C service, or whatever it may be.

186

00:38:33.640 –> 00:39:01.309

Jeffrey LeBlanc: keep that in a file, and that makes it so much easier that way. When that driver is involved in an accident. With that vehicle you go to that file, you grab, and you say I have everything that I need right here. Digital storage is easiest. Yes, paper files. Great. I’m old school. I like paper files, but I’m more and more on going to digital everything. I’m every time I have a file, sit there and I’m digitizing it. So all I gotta do is point and click, so that when I need to send it over to his office.

187

00:39:01.310 –> 00:39:11.490

Jeffrey LeBlanc: everything’s there. I’m not spending 2 h scanning it. It involves an accident secures much data as soon as possible. We had a fatality that took place

188

00:39:12.090 –> 00:39:33.030

Jeffrey LeBlanc: I don’t know 6, 8 months ago, and I told the business owner whatever you have on that driver on that vehicle, any mechanical record on any training you have on that guy. You need to grab that information and stick it in your safe, because ultimately it’s going to be being asked for depending on your your statue limitations. Louisiana is one, Texas is 2, Arkansas, 2 or 3.

189

00:39:33.120 –> 00:39:37.210

Jeffrey LeBlanc: I think it’s too. Most most are, too. Next slide.

190

00:39:38.660 –> 00:39:43.400

Jeffrey LeBlanc: Okay? So you’re served with a lawsuit. Now, what? Okay?

191

00:39:44.730 –> 00:40:06.470

Jeffrey LeBlanc: Yeah, I’m I’m speaking in Louisiana, in Louisiana. We’re served, whether you’re served directly by the sheriff, or it’s long serve to a what do they call it when they, when they hand it to a representative agent for service. Okay, make sure to get that lawsuit to either your broker or the insurance company asap. If 14 days in Louisiana just increased it.

192

00:40:06.470 –> 00:40:16.980

Jeffrey LeBlanc: Okay, so how many days is 21? It’s 21 days to respond. If you don’t respond you automatically, whatever they’re asking for, basically you get. I mean, that’s kind of the way it works.

193

00:40:16.980 –> 00:40:22.189

Jeffrey LeBlanc: So we have to make a response to the the plate of council.

194

00:40:22.330 –> 00:40:47.130

Jeffrey LeBlanc: gather up all your records, secure them, and then work with the claims adjuster. One of the key things that my firm has been working with is like the insurance companies, big insurance companies might be out of Dallas or New York or Pennsylvania, or whatever is they automatically assume that attorneys South, I 10 down in New Orleans and back rooms, or smarter than people up in North Louisiana and Luke, you know.

195

00:40:47.340 –> 00:41:04.530

Jeffrey LeBlanc: But if you take an attorney out of New Orleans and bring him into cattle parish in North Louisiana, he’s gonna get massacred because he’s not from here. Okay, we had one other day and talking to my friends in Houston. It was a big loss in Houston. They assigned Dallas Council.

196

00:41:04.560 –> 00:41:19.000

Jeffrey LeBlanc: and and we’re like, no, we wanna make sure that we have local counts as if you all need to work with your claim adjuster to figure out who your your your counsel is, because it does make a difference in the way the world works.

197

00:41:19.590 –> 00:41:22.610

Jeffrey LeBlanc: Play the defense counsel, play the counsel.

198

00:41:23.040 –> 00:41:37.819

Jeffrey LeBlanc: They duck up together, they fish together, their wives and Rotary club together. It all plays in. So if you take a guy in New Orleans in in Plus. We really got frustrated with one insurance company because they kept hiring this one firm out of New Orleans. Great firm, New Orleans.

199

00:41:37.930 –> 00:41:46.190

Jeffrey LeBlanc: He was charging us 6 h to drive up here from New Orleans at $300 an hour, or whatever it was, just to take their depositions.

200

00:41:46.290 –> 00:41:57.620

Jeffrey LeBlanc: and finally, I call the the adjuster, and I’m like I literally can walk across the street and have lunch with Luke, and he doesn’t charge me anybody to walk across the street. But we’re spending thousands of dollars

201

00:41:57.810 –> 00:42:02.759

Jeffrey LeBlanc: on these attorneys coming from different parts of the state.

202

00:42:02.790 –> 00:42:14.250

Jeffrey LeBlanc: that when we’ve got perfectly capable attorneys that know the judges that know the plan of attorneys. They know that they know their their playbook, and it just it works a lot better

203

00:42:14.490 –> 00:42:23.310

Jeffrey LeBlanc: Thursday. But I mean I couldn’t agree more. You you could not pay me to take a trial in New Orleans. I don’t know who those people are.

204

00:42:23.410 –> 00:42:40.700

Jeffrey LeBlanc: whereas up here. I know everybody. I’m in different associations with them. We have lunch sometimes, and it’s not just Louisiana, as you said. I mean Houston and Dallas. I mean I wouldn’t send a Dallas attorney to Houston, or a Houston attorney to Dallas. It’s look

205

00:42:40.870 –> 00:42:50.600

Jeffrey LeBlanc: if you made it through law school, and you’re a good firm. I understand you want the big city. I understand. A lot of clients want the big name

206

00:42:50.960 –> 00:42:53.969

Jeffrey LeBlanc: that’s great. You’re still gonna get popped.

207

00:42:53.980 –> 00:43:01.610

Jeffrey LeBlanc: and it’s not going to be worth it. It’s like, Okay, cool. I hired XYZ top 10 firm in the country, and then I paid 20 million dollars.

208

00:43:02.470 –> 00:43:07.450

Jeffrey LeBlanc: It’s not. It’s not worth it. I’m understand it sounds like I’m being very biased. But

209

00:43:07.900 –> 00:43:13.679

Jeffrey LeBlanc: I see it from the ground we just that for that reminds me that 49 million dollar case

210

00:43:14.070 –> 00:43:20.389

Jeffrey LeBlanc: out of town council got absolutely smoked. A great top tier law firm.

211

00:43:20.690 –> 00:43:27.790

Jeffrey LeBlanc: Does. You know today it’s just it’s just not worth it definitely higher local council anytime you can, anywhere it can.

228

00:46:22.860 –> 00:46:45.929

Jeffrey LeBlanc: Okay? So I previously talked about, I’ve got sitting on my desk 40-43 pages of discovery for a big one that I’m working on right now. So these are some of the things that this is almost carbon copies. If I get a lawsuit, this is pretty much what they’re gonna ask for. What’s your due diligence and hiring drivers? You know, I do a lot of will feel work.

229

00:46:45.930 –> 00:46:57.989

Jeffrey LeBlanc: And the good man. He’s a good guy, man, he he’s my brother’s uncle, and I’ve known him all my life. Great is he a good driver? You know. What is his MVR look like? Okay, have you? Have you run

230

00:46:57.990 –> 00:47:19.520

Jeffrey LeBlanc: due diligence before you hired this guy? And handing the keys to a $250,000 truck with a whole bunch of insurance. Did you find out? Did you investigate this guy? Okay, what was your onboarding process? Did you do a road test? Did you actually follow the guy around? Put a mentor in the truck with him to see if he knew what he did. He might have been driving for 5 years not to drive for 5 days.

231

00:47:19.920 –> 00:47:35.490

Jeffrey LeBlanc: What fun! One phone runs off always gotten and deal with construction. Well, feel, guys is to these younger folks that are coming up. They know how to backup a train. I mean, it’s crazy that some of these folks they’re going to work on these construction companies. They don’t know how to backup train.

232

00:47:35.670 –> 00:47:38.479

Jeffrey LeBlanc: What are your trainer qualifications?

233

00:47:38.670 –> 00:47:49.579

Jeffrey LeBlanc: That was a hot button on a couple of that we’ve seen is they went down a rabbit hole as far as you. Gotta. You have a person that is training our drivers.

234

00:47:49.810 –> 00:48:01.150

Jeffrey LeBlanc: What is his or her qualifications for training them? And they wanted everything. And they wanted to know everything about that person. Their experience, and went on down the road

235

00:48:01.160 –> 00:48:15.629

Jeffrey LeBlanc: Drug and alcohol testing, making sure you’re abiding by your policies, guys, if you’ve got a drug and alcohol testing policy, and it says that after every accident we’re gonna drug and alcohol test. You better dog on do it because you know what one time you don’t is the one time you’re gonna get burnt

236

00:48:15.930 –> 00:48:34.019

Jeffrey LeBlanc: daily, weekly vehicle inspection forms. I cannot stress this enough. Whether it’s DOT. I know they’ve got pre and post the non DOT. Is where we seem to get hammered, because that plaintiff attorney says, Hey, when’s the last time you did an inspection on that vehicle?

237

00:48:34.430 –> 00:49:00.889

Jeffrey LeBlanc: A lot of times I’ll get a deer in the head like look from the business owner, and it’s like we’ve never inspected. We had a there was a a big case here in in in street port, where it was a church van that they were taking a road trip to Dallas for over the youth trip. And there was, I don’t know, 10 or 15 kids in there, and ultimately one of the back tires wound up, blowing out, and one or 2 kids were seriously hurt. I think there’s one fatality in it.

238

00:49:00.890 –> 00:49:08.819

Jeffrey LeBlanc: The second question from the plaintiff attorney representing the child that had been killed was, let me see your inspection form on that bus.

239

00:49:09.030 –> 00:49:11.710

Jeffrey LeBlanc: and there literally was a deer in the headlight book.

240

00:49:11.830 –> 00:49:18.470

Jeffrey LeBlanc: and that went from a manageable claim to a very expensive claim very, very quickly.

241

00:49:18.480 –> 00:49:39.069

Jeffrey LeBlanc: Driver, driver training MVR, and then previous, and fractions. One of the things we started pushing pushing through our clients was, Mark, help me on. This is the PSP. Through the DMT. Is that right? And and what we did was, it’s an investment. I don’t know how much it is, but it’s like this tells you

242

00:49:39.890 –> 00:49:54.039

Jeffrey LeBlanc: the inspections that have taken place for John Smith or Jane Smith, these drivers, and if you’ve got a consistent pattern that these folks are getting getting pulled over and written tickets. You’re hiring your next problem.

243

00:49:54.040 –> 00:50:16.269

Jeffrey LeBlanc: So be very cautious of that, and if you’re getting a bad vibe that, hey? This doesn’t add enough as far as the number of inspections in the out of service, and they’re not doing their due diligence as that driver of taking care of their fields. And it’s really worked positive. The guys that we recommended that to you kind of watch that number go down slightly because they quit hiring their problems

244

00:50:16.600 –> 00:50:17.970

Jeffrey LeBlanc: next slide.

245

00:50:19.070 –> 00:50:30.030

Jeffrey LeBlanc: More information asked for in discovery vehicle. We’ve been over that vehicle. Maintenance records. I mean anything they can think of. Okay, cell phone records. Now, here’s the thing, the new

246

00:50:30.100 –> 00:50:35.889

Jeffrey LeBlanc: they’re asking for cell phone records. Everybody’s kind of trying to drive a cell phone policy out there.

247

00:50:36.140 –> 00:50:47.730

Jeffrey LeBlanc: but they also are pulling their personal as well as their business phones. They had a case here in Shreveport, where there was a car salesman. It was on a Sunday. The

248

00:50:47.960 –> 00:50:49.909

Jeffrey LeBlanc: dealership is not even open

249

00:50:50.910 –> 00:51:01.969

Jeffrey LeBlanc: because the car salesman gives out their phone number to work through the process. The client called the car salesman. He’s driving down Burkin’s on his personal phone on his day off

250

00:51:02.400 –> 00:51:06.799

Jeffrey LeBlanc: and have an accident. The plaintiff attorney subpoenaed the records.

251

00:51:07.020 –> 00:51:29.639

Jeffrey LeBlanc: got the cell phone records, saw that he was on the phone discussing a business transaction. So therefore, guess what it looped the company in. So it went from his $50,000 personal limits. All of a sudden. We’re sitting up there with 1 million dollars. So it became very interesting to know that I also want personal phone. They still can of those records

252

00:51:29.980 –> 00:51:46.800

Jeffrey LeBlanc: they’ll ask for toll receives. You have to receive. This is all DOT stuff, GPS tracking camera video dispatcher files. Then we went down one with the dispatcher. They wanted to know everything that that person had been dispatched for that week as well as that month. That’s a lot of data that we had to gather

253

00:51:46.920 –> 00:52:03.830

Jeffrey LeBlanc: police reports on any previous accidents in regards to the accident involved. But it’s also any other previous accidents for the company for the last 5 whatever a year they 5 to 10 years. So we had to go back and track down basically every file that we had been in an accident with. With this phone company coming

254

00:52:04.150 –> 00:52:13.300

Jeffrey LeBlanc: photos of the vehicle, written statements. I mean anything and everything as far as specification to it. So big data is out there.

255

00:52:13.400 –> 00:52:38.449

Jeffrey LeBlanc: Know that the better you use technology, we’ll get a technology a second, the better you use technology and store that technology the better that, you’re gonna be as far as setting yourself up. Is there anything you want to add on any of this for? I think we’re running a little long, so I’ll just say briefly all of your drivers need to know that if you get if they you get their cell phone records, it’s not just who’s calling. Who’s texting? Who

256

00:52:38.620 –> 00:52:43.110

Jeffrey LeBlanc: you can find out if they’re streaming, because there’s a difference in dating.

257

00:52:43.790 –> 00:52:58.010

Jeffrey LeBlanc: And what one to you. If your employee is streaming the game while driving, as an accident is that will come out, and then you’re in a whole world of trouble. So I next slide. So I need to consider that we we put together. This.

258

00:52:58.040 –> 00:53:05.210

Jeffrey LeBlanc: a good defense is a great offense, you know. Be a defensible client. Mark and I had a conversation about that. We need you to be defensible

259

00:53:05.440 –> 00:53:32.410

Jeffrey LeBlanc: and being compliant, compliant, or I am OSHA compliant, man, that’s just that’s just scratching the surface. You have. Go back to the are you good, or are you lucky? You have to be good investing technology now, going with it, investing technology like cameras, GPS training platforms such as great. What we’ve got here with these guys on on board right here. It’s great love it. I’m a big proponent of it. Doing background checks.

260

00:53:32.460 –> 00:53:43.220

Jeffrey LeBlanc: something that the underwriters or are certain insurance companies now. The underwriters are moving to, and pretty much if you don’t have cameras in your vehicles now.

261

00:53:43.220 –> 00:54:09.239

Jeffrey LeBlanc: it’s gonna be real hard to be getting to be getting insurance over the next couple of years within the next. I’m saying the next 5 years, and maybe even faster than that. If there’s not cameras sitting out there and depending on what kind of cameras? Well, what platform are you running? Are you running a cheap one from Target, or you run into really good move from XYZ company. It does make a difference. And then monitor, your employees got all this technology you got cameras. You got GPS, you got all this stuff.

262

00:54:09.350 –> 00:54:23.500

Jeffrey LeBlanc: If you’re not monitoring that information, the plantiff attorneys will absolutely hammer you on this. Oh, you knew that he had speed the last 20 times he got in the car. Oh, you knew that he had made hard breaking, and you’re not pulling your employee and go, and I’m not saying

263

00:54:23.910 –> 00:54:47.650

Jeffrey LeBlanc: use it as a disciplinary thing. Use it as a a learning opportunity, hey? We’ve noticed over the last couple of couple of days that you’re all set hard breaking. Is there something we know about as far as the route that you’re taking you on? Is there? You know, you’re you’re doing your speeding through this school zone, you know. Schools back. Use it as a coaching in the mentoring process next slide.

264

00:54:50.090 –> 00:54:54.910

Jeffrey LeBlanc: Okay, have good record report and stitch. You talk about that. One of the things

265

00:54:55.540 –> 00:55:07.279

Jeffrey LeBlanc: I’m employed with several of my clients folks. If you don’t have a first movement forward procedure, and you drive a lot of times a lot of service trucks. They’ll do a lot of mechanical contractors and contractors.

266

00:55:07.580 –> 00:55:26.990

Jeffrey LeBlanc: and you’re the first movement, for when you get in that truck, and like, I’ve got one account of contractors that have the the tool boxes on the side, it’s really hard to see on those things, and they’re they’re always hitting non-moving vehicles, or a pole, or a tree, or whatever it seems like. Make it to where your first movement is forward.

267

00:55:27.230 –> 00:55:48.380

Jeffrey LeBlanc: I’ve implemented that with several of my old clients, and they’re literally their their boo-boo accidents where they’re bumping in something that one movement went down by like 80%. Make sure there’s a great great process to put in when they pull up to a store park out back into the parking spot, park away, and that helps you keep them from hitting something.

268

00:55:48.410 –> 00:55:55.929

Jeffrey LeBlanc: Train your employees what to do, what to say and how to save when they get in an accident, and one of the examples I give

269

00:55:56.030 –> 00:56:02.720

Jeffrey LeBlanc: person get they bump into somebody or red light to walk up to it. I am so sorry that I hit you if I say that. What if I just admit it?

270

00:56:02.940 –> 00:56:20.400

Jeffrey LeBlanc: Yes, just a little bit. So what if you say I’m sorry we met this way. Are you injured? Cannot call somebody for you. You said exactly the same thing. You’ve shown compassion, but you’ve not admitted liability.

271

00:56:20.400 –> 00:56:46.660

Jeffrey LeBlanc: Okay, train your employees to take pictures. We talked about that as far as a lot of pictures, lot of pictures, lot of pictures, and then the bottom there. Consider. If you have policies, procedures, make sure to stick to make sure somebody’s not deviating from your policies and procedures. That’s a huge hammer on the lawsuit side of things. Correct? Yeah, absolutely. And if I’m just gonna take a few things from the list just put together, my my dream list here is

272

00:56:46.890 –> 00:56:53.579

Jeffrey LeBlanc: dash cams. That helps me know whether or not the that helps me defend the actual driver.

273

00:56:53.820 –> 00:57:00.870

Jeffrey LeBlanc: Training is huge. That is become a big thing in our jurisdiction. I know what others. If you have records of training.

274

00:57:01.150 –> 00:57:21.099

Jeffrey LeBlanc: we’re great, because here’s the thing. Juries sometimes will be sympathetic to a driver, you know, just a good old boy didn’t mean no harm. It happens they are not sympathetic to a company. They will pop a company, especially if there is no record of training like I’ve got a few insured trucking companies where

275

00:57:21.520 –> 00:57:24.690

Jeffrey LeBlanc: they hire you site unseen, and you just go.

276

00:57:25.090 –> 00:57:35.480

Jeffrey LeBlanc: They’re getting popped every time. So those are things that I really would like to see. Okay, Steve, how are we on time? I got about 10 min left. We? Good. Okay, alright real quick.

277

00:57:35.520 –> 00:57:36.700

Jeffrey LeBlanc: Next slide.

278

00:57:37.820 –> 00:57:41.050

Jeffrey LeBlanc: Okay, your broker expectations. If you’re dealing with broker

279

00:57:41.130 –> 00:57:50.259

Jeffrey LeBlanc: on average, you’re spending about making up a number. If you spend a hundred $1,000 wonder insurance. You’re paying 10% of that premium to your agent to help you with that?

280

00:57:52.350 –> 00:58:21.750

Jeffrey LeBlanc: Does your broker know all the programs and safety? Is he going to the underwriter and saying, Do, here’s what makes Company A better than Company B. We talked about under riders being overwork. If he’s got 50 files sitting on his on his or her desk. What makes that file go up to the top? Okay? Meaning instead of having number 49 out of 50. What makes you go to the top is that broker know all the programs safety technology that you have in place? Specific types of technology?

281

00:58:21.760 –> 00:58:47.420

Jeffrey LeBlanc: Are they presenting this information? See? To get to get better premiums? Because if those underwriters know that you’re doing the right thing, you got the technology, you’re doing all that stuff. It’s gonna make them look better in their eyes. And are you working closely with your underwriter? Your claims represented that broker should be fighting for you. If you’re spend $100,000 on premiums and 10,000 that go into your broker when you calling when the ship hits the sand.

282

00:58:47.620 –> 00:59:06.219

Jeffrey LeBlanc: Is he just flipping you to the insurance company and saying, Handle it? Okay? Or is he actually helping you manage the claim through the client work through the claim work with council and doing all the things you’re paying to do. I call home generator theory or theory right now. Home generators are big because we’ve got all the hurricanes and stuff.

283

00:59:06.570 –> 00:59:24.979

Jeffrey LeBlanc: I guarantee that if I walked in some of these business owners and they just bought $20,000 home generator that they know more about their home generator and what it can do for their house and all that kind of fun stuff versus what their insurance policy you can cover, or how their broker can help them with that process of having a claim next slide.

284

00:59:26.490 –> 00:59:43.990

Jeffrey LeBlanc: Okay, strengthen your relationship. Does that? Does that broker you’re paying that 10%, does he have a claims department in house? We’ve got a claims department with an in-house attorney also got a DOT sitting there, and I’ve got another. I’ve got 2 claims, folks that we help these clients manage these claims.

285

00:59:44.050 –> 00:59:54.530

Jeffrey LeBlanc: Are they ensuring? We hit long time that are getting local, counseling Alison in my office. Who’s our in-house counsel? She hammers those claims, gestures going. We want somebody local.

286

00:59:54.570 –> 01:00:02.220

Jeffrey LeBlanc: We and she’s mean about, she’s good about it. Are you doing active claims, reviews? If you have a couple of others?

287

01:00:02.220 –> 01:00:25.769

Jeffrey LeBlanc: Do you know what’s going on with your claims? If you just turn it over the insurance company and think they have your best interest in place, they don’t. Okay, they want to settle it, but they might have to spend another 25,000 to make it go away. But if you have a claims manager at your broker level to go look, we think we have a good case that we can work with. We can get it settled for 10,000 versus 35,000.

288

01:00:25.770 –> 01:00:36.589

Jeffrey LeBlanc: That’s within that claims review monthly quarterly. Sometimes we even have claims, reviews week on these big, nasty claims that we know what’s going on final, I’m gonna touch on this real quick

289

01:00:36.630 –> 01:01:03.299

Jeffrey LeBlanc: Is a group captive insurance program fit for your company. That is a total, another webinar. But there’s a lot of information out there, and our company is really good. Good with it. We’ve got about 30 to 40 clients that are in group captive insurance companies. It’s a way that customers can save on their insurance rates. It doesn’t work for everybody, because there’s certain things. And Mark and I had a long sense of conversation about this. There are certain programs that are out there that are helping

290

01:01:03.300 –> 01:01:15.169

Jeffrey LeBlanc: the good thing about a cap that are helping them kind of flatten their insurance costs, and it’s a great deal if you can, if you can meet some of the the requirements of that program.

291

01:01:15.830 –> 01:01:17.820

Jeffrey LeBlanc: Final slide.

292

01:01:19.130 –> 01:01:29.680

Jeffrey LeBlanc: So those questions we went through. If you answer no to any one of those questions. You might have the wrong broker. I mean, we’re good and what we do. I’m sitting here telling you that we can help you with your with your process.

293

01:01:30.060 –> 01:01:51.650

Jeffrey LeBlanc: My name and number looks, name, number, mail, the back of this thing. We’re happy to help you. Questions about any of this stuff at a much deeper level. Happy to visit with you. Got got the can producers that can talk to you, and and walking down some of the path. I do more of the lost control and safety side of things. And I’m happy to talk to you about those? Any any questions, Mark? Steve?

294

01:01:53.190 –> 01:02:08.680

Steve Kessler: Yeah. Thanks a bunch. Jeff and Luke. Some fantastic information. Couple of questions did come in, you, answered one, and we had a question about captive insurance. But do you ever recommend

295

01:02:08.680 –> 01:02:35.430

Jeffrey LeBlanc: training, or even simulating a crash as part of training or making sure that people are prepared and can get the information necessary, when these lawsuits do come in? I’ll go out to to clients offices and actually set up an accident one time it was just a minor. We we back 2 trucks up to one another. Presentations that I do. It’s about accident investigations.

296

01:02:35.470 –> 01:03:01.510

Jeffrey LeBlanc: We have a literally have a little dummy car or model car, and assigned a picture from here like, if this is the car, I need pictures on all 4 corners. I need pictures all the way around it. I need pictures of the streets. I need pictures of the stop lights. I need a video of, you know, one of the big things that we’re having trouble with years ago down South Louisiana, is you would. There was a thing that took place down in New Orleans, where it was the setup, and it was it was one that organized crime

297

01:03:01.510 –> 01:03:06.100

Jeffrey LeBlanc: where they would have a predetermined route into that buses going on, and there’d be.

298

01:03:06.160 –> 01:03:25.930

Jeffrey LeBlanc: you know, 10 people on the bus. We have a minor accident full of folks, and then they stop at the at the the predetermined location. The bus driver would get off to go talk to the, to the person that bumped in, and about 15 or 20 people would get on, and all of a sudden 10 people on bus and having 40 people on the bus, everybody’s injured.

299

01:03:25.990 –> 01:03:30.720

Jeffrey LeBlanc: So taking pictures, if you can, of how many people were in the vehicle.

300

01:03:31.380 –> 01:03:43.670

Jeffrey LeBlanc: Yeah, do exactly. And you know, get there, officer. There was only 2 people in this car, all of a sudden this carload of people showed up another 5 people in the car that just that’s just blatant fraud happens every day. Unfortunately.

301

01:03:43.910 –> 01:03:54.659

Steve Kessler: No, that’s great. Thank you for that. One last thing that I’ll point out here you mentioned several times. That’s important to

302

01:03:54.820 –> 01:04:00.180

Steve Kessler: to provide training for your clients. Do you recommend online training?

303

01:04:00.250 –> 01:04:12.559

Jeffrey LeBlanc: Absolutely. Yeah. The the challenge 90% of my clients have is getting those drivers out of the field into a predetermined location because it’s downtown. Yeah.

304

01:04:12.740 –> 01:04:30.440

Jeffrey LeBlanc: But the the program that you offer through Infinit-I is awesome, like. So we do a lot of a lot of drivers. And if they’re sitting waiting to load. And you’ve got 5 assignments that you got for these guys for the month. They literally go on their phone and you press a button, and they watch the 3, 5, 7 min video.

305

01:04:30.740 –> 01:04:51.830

Jeffrey LeBlanc: It gives them good training. It gives them stuff is recorded. So when you do have the accident. You can go pull the records for John Smith and hand them directly over to to Luke to go. Hey? He went. Took this on speeding on this day. At this time it works great. I’ve got several customers that are on your program, and they absolutely love it.

306

01:04:52.110 –> 01:04:55.409

Steve Kessler: Great. Thank you for that. So

307

01:04:55.460 –> 01:05:22.890

Mark Rhea: I think we’ve pretty much come to the end of our time. Here, guys, thank you so much. Jeff and Luke. Fantastic information. Mark, do you have any final comments? No, I just I know that. If you are not a client, that we could certainly get you set up with a demonstration. Free demonstration immediately. There’s a poll question right there you can literally get some content going out to your

308