Safety Training that Reduces Your Trucking Insurance Costs

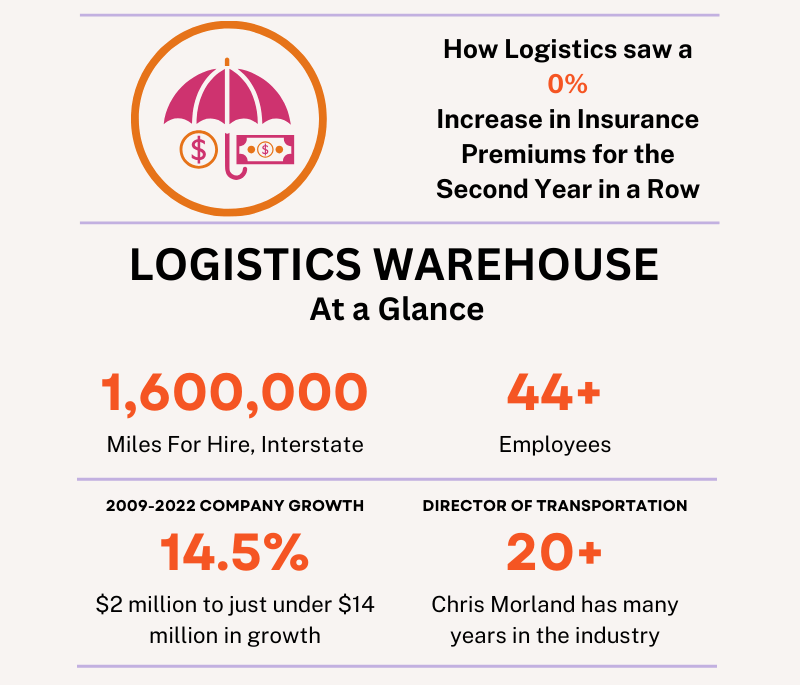

Insurance premiums going up? Infinit-I client Logistics Warehouse used three simple steps to reduce their trucking insurance costs (YES, 0% increase for the last 2 years and counting!). It CAN be done and it WILL have a huge impact on your company’s operations.

What Does an Insurance Underwriter Want to See?

Insurance is all about calculated risk. Every time an underwriter reviews a policy, they’re calculating the potential losses (or gains) of covering you.

If you’ve read the news about nuclear verdicts, staged accidents, and cargo theft, you know that our industry is targeted from all sides. That means the probability of a claim is high and the risk to insurance companies who cover you is high, too.

Remember if you lose, they lose.

Insurance companies are more likely to do business with you at a favorable rate if you have a documented track record of prevention, a culture of safety across the company, and positive trends when it comes to reducing violations and accidents. Managing your business for this will not only make you a better bet for insurance underwriters, but also a more profitable company.

Industry Threats Your Underwriter is Worried About

Nuclear Verdicts

In recent years, nuclear verdicts have become more frequent. The average verdict has more than tripled, increasing from $64 million to $214 million between 2015 and 2019. Companies hit by nuclear verdicts often must file for bankruptcy or shut down entirely. We’re starting to see tort reform in key states to address the outrageous judgements, but until there are widespread changes, the financial risk of operating unsafely is high for both you and your insurance provider. Insurance underwriters love to see proactive safety training that is documented. They know that if an accident happens, those records will stand between you and more zeroes on a judgement.

Staged Accidents

Staged accidents are another growing issue because of nuclear verdicts. In New Orleans, the FBI’s “Operation Sideswipe” has exposed approximately 50 individuals involved in falsely reporting wrecks involving tractor-trailers. It’s estimated that there have been 150 staged accidents in the New Orleans area alone. However, this issue is not limited to Louisiana. Targeting trucks has unfortunately become a dangerous “get rich quick” scheme across the US. In-cab cameras are essential to catching these predators in the act. Proactive training about this issue will also keep drivers alert and prepared to handle staged accidents.

Cargo Theft

Cargo theft is on the rise. In the second quarter of 2023, CargoNet reported “566 incidents in the U.S. and 16 in Canada, a 57% year-over-year increase compared to 2022”. Although food and beverages are the usual targets for cargo theft, criminals will steal anything that is in high demand in the retail market (remember 2013 reports that Tide detergent has become ad hoc street currency?). While some food prices are decreasing, the market remains unstable. In August, food prices increased by 4.3% compared to 2022. This indicates that cargo theft in this market will likely continue throughout the year. Train your drivers to check identification and use secure pick-up numbers.

Preparing for your next insurance renewal? Here are a few factors that determine your trucking insurance costs:

- How many claims has your company filed in the last 3-5 years?

- Are you showing a decrease in claims over time?

- What are you doing to prevent accidents and incidents that lead to claims?

- Is everyone in your company on the same page about reducing accidents and incidents? Is that prioritized above everything else?

- Is everyone participating in prevention measures? Are they all completing their training?

- Does your company have a culture of safety?

The best way to reduce your trucking insurance premiums is by being a safe bet. You don’t need a spotless record. It’s all about showing downward trends over time and prevention plans like proactive safety training and communication.

Don’t think it’s possible? Ask Logistics Warehouse.

Chris Morland, Director of Transportation and a 20-year trucking veteran, helped Logistics Warehouse Inc flatline its insurance rates two years in a row. Despite quarterly safety meetings, the company’s accident rates weren’t improving. Chris introduced monthly training on Infinit-I and required participation. He incentivized training with a safety bonus, which led to 99% participation.

With that solid foundation in place, Chris was able to use the quarterly in-person meetings to reinforce online training and share accident, violation, and expense trends with drivers. That kind of open communication and transparency led drivers to buy-in to their role in improving safety and reducing accidents, claims, and maintenance issues.

Not only is Logistics Warehouse more profitable, it also saw a 0% increase in insurance premiums. You can read more about Chris’s story and achievements by completing the Logistics Warehouse Coverage Case Study form below.

Simple Steps You Can Take to Reduce Your Insurance Costs

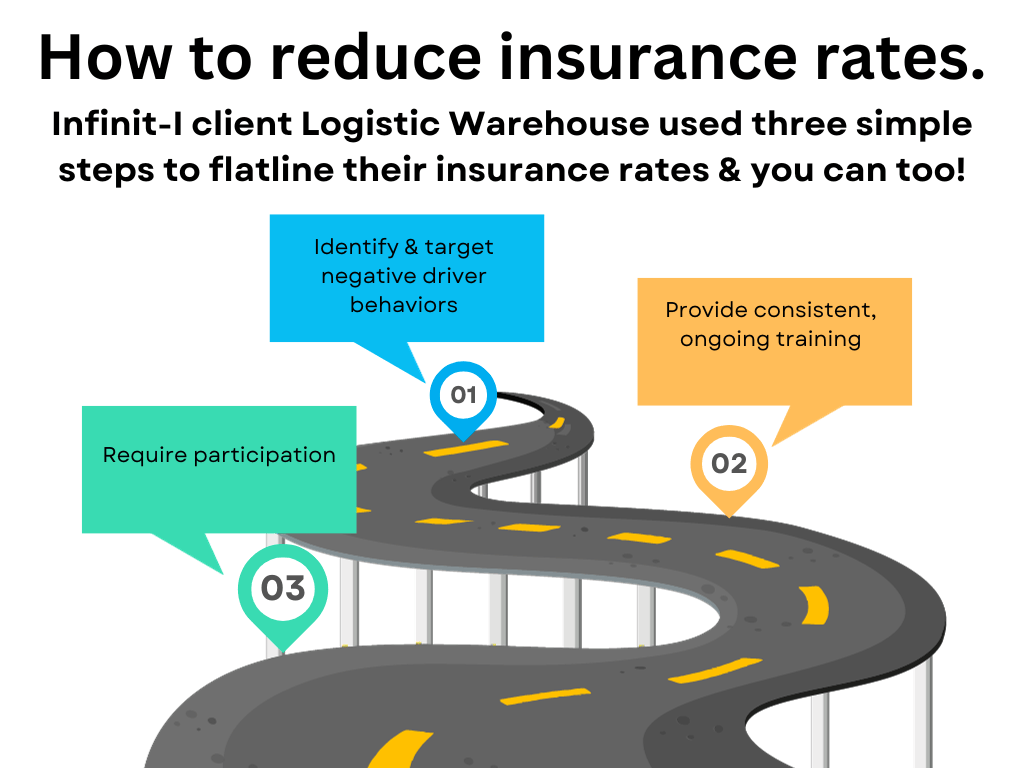

Follow these steps to see the same results as Logistics Warehouse:

-

Identify Risk Areas & Target Related Driver Behaviors

Pull your accident, incident, and claim history. Better yet, pull this alongside your company’s balance sheet. If you see a high number of speeding violations or an increase in tire repairs due to distracted driving, for example, you know where to target training.

If you need help, talk to your insurance underwriter. They can detail exactly why your premiums are high and rising.

-

Provide Consistent, Ongoing Training

One-off training does very little to reinforce the right behaviors. If you want to actually change habits and reinforce safe practices, you need to train frequently and consistently. Aim for monthly training, but don’t overload your assignments. Cover no more than two to three topics each month. Include an assignment on distracted driving since the nationwide stats keep climbing.

Infinit-I makes it easy to preschedule your monthly training so you know it’s covered. And since our videos are each about 8 minutes long, they will be easy to tackle.

-

Require Participation

Providing training is pointless if nobody uses it. If you actually want to decrease accidents, incidents, and claims AND improve profitability and insurance premiums, you must require participation. Many of our clients, including Logistics Warehouse, use both a carrot and a stick to incentivize training. Smart companies also take time to explain why training is essential to both the success of the company and the safety of the driver and motoring public.

It can be scary to require participation, but we’ve never once heard a client regret the decision. It weeds out the drivers who are the greatest risk to your company, making your job a lot easier in the long run.

Download the 2023 Logistics Warehouse case study.

If you do these three things, you will see a safer fleet, better insurance premiums, and room to move your business forward. The best time to start is now! Schedule time to see how Infinit-I’s online training platform can streamline your proactive, preventative training, and hear why we’re the #1 most referred LMS by insurance.